Tariffs and Liberation Day, the Stock Market, and Foreign Direct Investment in the U.S.

Media Hit, 4/3/25

I’m on NewsMax twice today, once in the AM and again in the PM. Anyway, on to the talking points!

Liberation Day Tariffs and Stock Market

Link: https://www.cnbc.com/2025/04/02/stock-market-today-live-updates-trump-tariffs.html

Lots of drama surrounding this one. First is the “how did they come up with those numbers, anyway?” fiasco.

James Surowiecki over on Twitter appeared to have cracked the code first. All they did is divide the trade deficit with a country by their exports.

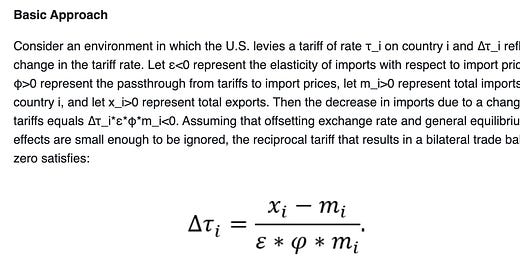

Then, the US Trade Representative’s office released this description, which has some fancy math:

Which, if you work through it, the fancy letters cancel out and you’re left with… a country’s trade surplus with the US divided by its exports to the US.

So it appears that Surowiecki is right, even if Trump officials deny it, which is weird because the math literally works out to be “trade surplus divided by exports” and then cut in half to “be kind.” But whatever.

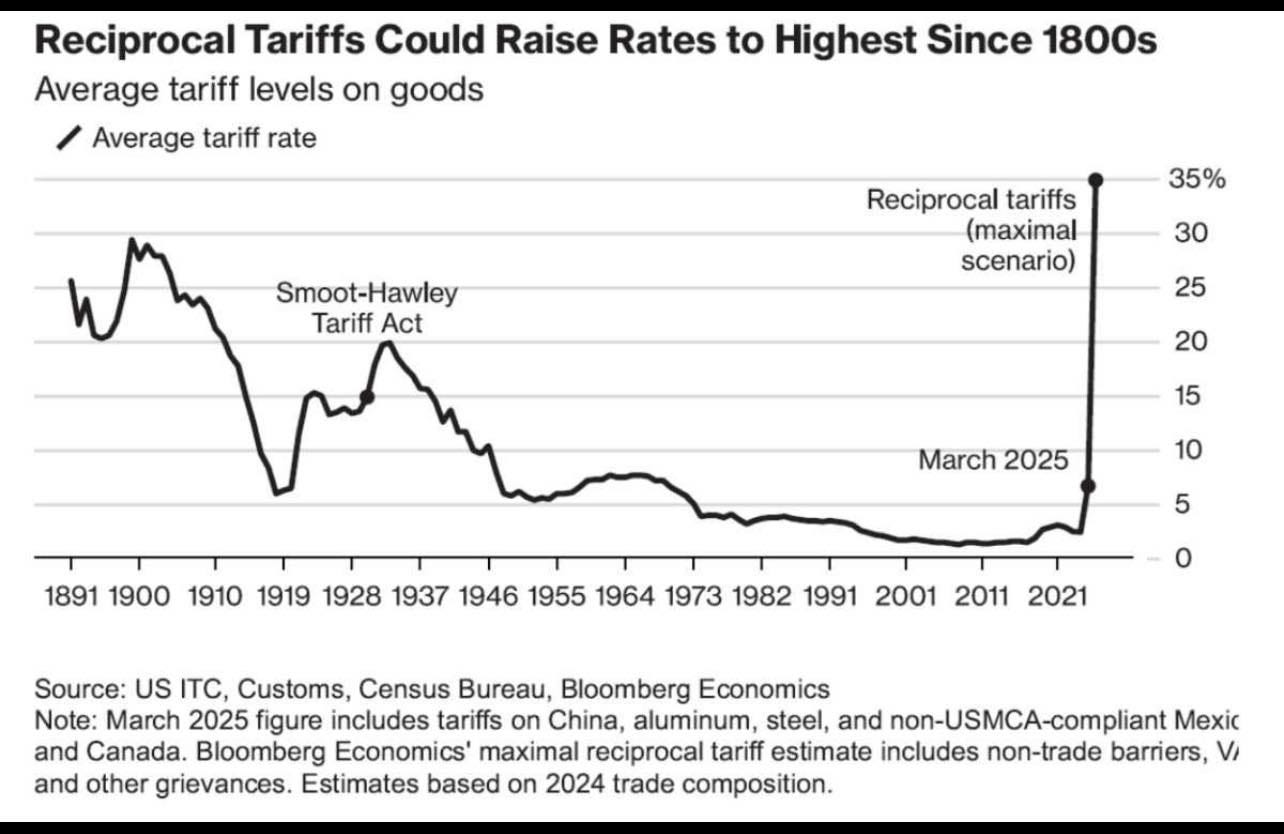

This is the single largest increase in tariffs this country has ever seen:

So you know, that’s cool.

But what will the effect be?

Negative. But it’ll be offset by Trump’s efforts to deregulate (good), lower other taxes (also good), and pay off the debt (good).

But all of this ignores the question of why manufacturing jobs have disappeared?

One is obvious: the rise of other countries as a place where manufacturing can happen. Think China and India. Their wages are much, much lower than ours and, for cheap, easy-to-build assembly processes, it makes far more sense to have them do it than to do it ourselves.

A second is less obvious, but far more supported by this funny little thing called “evidence:” increased productivity of the American worker.

I’ve said it before and I’ll say it again today most likely: the American worker is the envy of the world. We are, on a per-capita basis, the most productive workers, period.

Because of this, we do not make “cheap trinkets.” It’s just not worth our time to do so. We make high quality, high skill manufactured goods.

But also, that American worker productivity has risen so much over the past 40 years, it stands to reason that there would be fewer jobs in manufacturing unless there was a commensurate increase in purchasing of American goods.

For example, if American workers were 50% get productive, there will be fewer manufacturing jobs in America if sales of manufactured goods do not increase by at least 50% as well.

This is why we can clearly see that, yes, there are fewer manufacturing jobs in America today than there were in the past. But we’re also at near-record levels of manufacturing output.

We still “make things,” we just require fewer people to do so than before, not unlike what we’ve seen in the agricultural sector over the last 100 years.

Foreign Investment in the U.S.

In isolation, this is great. But it’s not in isolation, it’s in response to the tariffs.

These companies are not coming here because America is somehow better for them, they’re coming here because not coming here is worse.

We can contrast this with how Reagan went about accomplishing the same goals: through lowering taxes and deregulation, which spurred American manufacturing by American firms, increased jobs in manufacturing, lowered prices for Americans, lowered costs for production, and yes, attracted more foreign investment… the list goes on and on.

Reagan attracted foreign investment. He didn’t compel foreign investment.

Once again, the big winners from all of this are going to be… foreign companies!

It’s really strange to me that the most “America First” president of all time is proud of the fact that he’s rewarding foreign companies and punishing domestic ones.

So What Happened?

For the morning segment, there’s not much to really report here, I’m afraid. Pete Sepp of National Taxpayers Union and I sat in the waiting room of the Zoom meeting while NewsMax (justifiably) congratulated themselves for this incredibly achievement. I do not begrudge them one bit for this. By the time we went on, we each got asked one question. I went first, got asked “what do you think of our IPO?” and answered that I was happy for them, that it was a great achievement, and that they overcame great odds not unlike the 1980 Men’s Olympic Hockey Team in what became known as The Miracle on Ice.

For the afternoon segment, I was on NewsMax2’s The National Desk. It was just me and the host, which was a nice change, especially compared to this morning’s segment. Don’t get me wrong, I love Pete Sepp and think he’s great, but it was nice to get multiple questions and to give actual answers to questions.

I was really excited to get a point in that I’ve been working on all day, saying something to the effect of:

First of all, I want to congratulate you all on an amazing IPO this week and on today’s ringing of the bell. It’s a great achievement and you all overcame great odds even when the deck was stacked against you. I’m really, really happy for you. What’s interesting, though, is that President Trump has been saying that the deck is stacked against the American worker. Unlike you all, though, he evidently does not believe that the American worker can overcome this… unless he steps in and saves you all. So it’s really interesting to see an America First president not believe in the American worker.

This, I think, flummoxed the host but we had a great segment regardless, which is a testament to her temperament as a host.